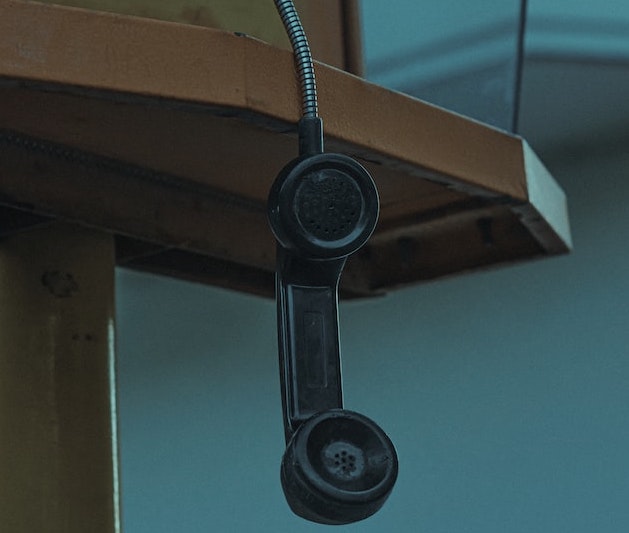

As a consumer protection lawyer, one of the most common questions I receive from clients and non-clients alike is, “how do I get debt collectors to stop calling!?.” Having creditors constantly calling is a stressful and unpleasant experience, to say the least. Fortunately, there are measures that consumers can take to keep debt collectors from incessantly calling and trying to contact them each day of the week.

Under the (FDCPA), consumers have the right to tell debt collectors to cease and desist all communication with them, meaning, by law, they must stop calling, emailing, or sending letters to the consumer. To exercise this right, the consumer must send a written letter to the debt collector requesting that they cease all communication; the letter should be sent via certified mail with the return receipt requested to prove the collector got the message.

It is important to note that once the debt collector gets a cease and desist letter, they can only contact the consumer to say that they will stop collecting or state that they intend to take legal action, such as filing a lawsuit or repossessing a vehicle. Any other communication from the debt collector after receiving a cease and desist letter violates the FDCPA. Some creditors knowingly violate the cease and desist, betting the consumer will not find legal representation to seek damages. Others are so disorganized that they break the law carelessly.

If you tell a debt collector in writing that you will not pay a debt, this has the same effect as a cease and desist instruction. You might do this if you know you don’t owe the debt.

Debt collectors may sometimes contact you via text, email, or even private messages on social media. Under Consumer Financial Protection Bureau regulations, you always have the right to opt out of such messages; this means that a collector could only contact you by conventional means such as letters and phone calls.

If a debt collector knows an attorney represents you, the debt collector is not allowed to contact you unless they cannot reach your attorney.

If you think you owe the debt and want to pay it, you may be able to negotiate a payment plan with the debt collector. Before you do this, you should make sure that:

When you are ready, you can contact the debt collector, explain your situation and make an offer to settle. If you need time to pay, ask for a payment plan. You should always ask for written confirmation of any settlement and keep records of the payments you make.

If a debt collector, or collectors, are harassing you or a family member despite attempts to stop the calls, enlist the help of a debt collection harassment attorney. After carefully reviewing your harassment situation, we’ll determine if the debt collector is violating the FDCPA or other consumer protection laws and seek damages for their unlawful behavior.