The CFPB started collecting consumer complaints regarding debt collection in July, 2013. Fourteen months later, the data for Maryland paint an interesting picture of the collection industry’s activities in the state.

The CFPB received 958 complaints about debt collection from Maryland consumers between July 10, 2013 and September 17, 2014.

Content of Complaints

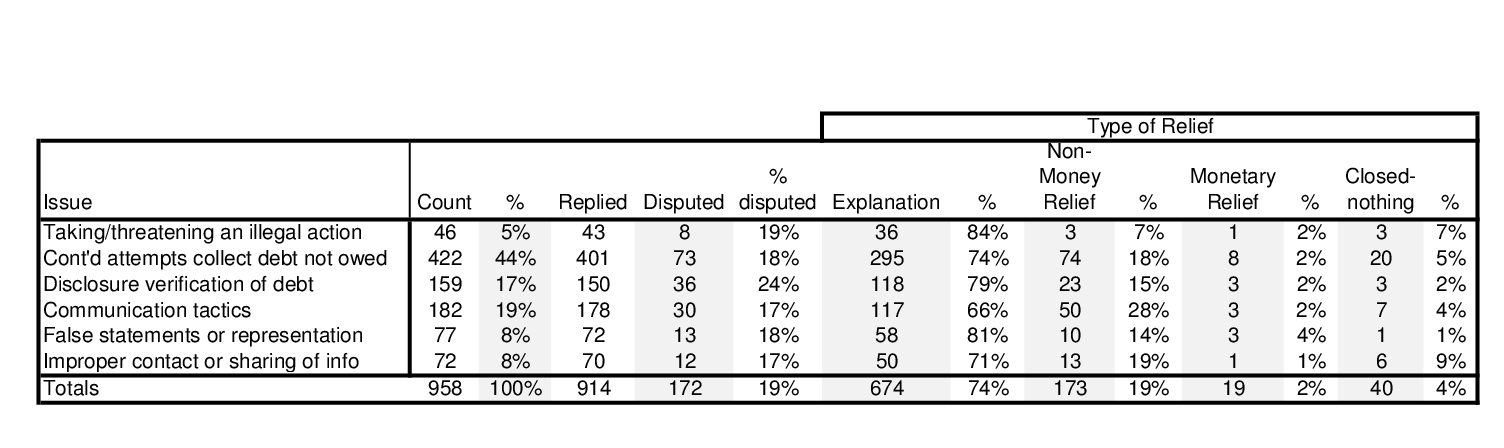

The CFPB recorded six categories of “issues” complaints. The most common complaint by far was “continued attempts [to] collect debt not owed”, with 422 cases (44%), then “Communication tactics”, 182 cases (19%), “Disclosure verification of debt”, 159 cases (17%), “False statements or representations”, 77 cases (8%), “Improper contact or sharing of information”, 72 cases (8%) and finally “Taking/threatening an illegal action”, 46 cases (5%).

The CFPB also recorded “sub-issues” providing a greater level of detail about the nature of each complaint. Among the 26 sub-issues, a few stand out. “Debt is not mine”, with 252 cases (25%) accounted for a quarter of all complaints and more than half of the complaints about attempts to collect debts that is not owed. Other leading complaints were: the debt demanded had already been paid, 123 cases (13%); frequent or repeated calls, 121 cases (13%); not being given enough information to verify the debt, 113 cases (12%).

A few complaints also indicate those some debt collectors continue to engage in the most serious forms of misconduct: in 8 complaints were about impersonation of an attorney or official, 4 about lawsuits without proper notification of suit and 19 complaints related to threats of arrest if the debt was not paid (with a further 3 involving claims that non-payment was a crime).

Companies Complained About

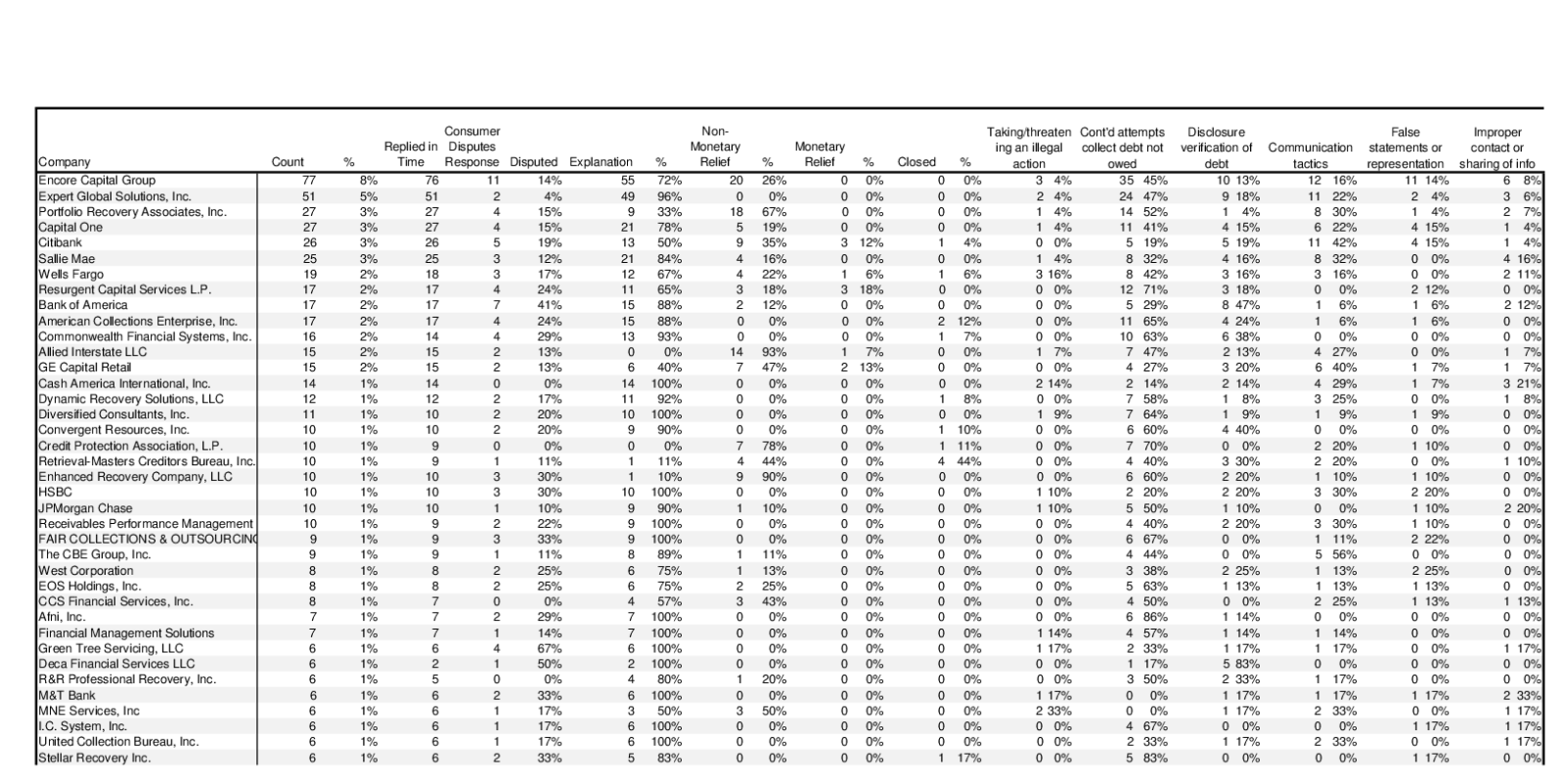

The top three complained about companies were Encore Capital Group with 77 complaints (8%), Expert Global Solutions, Inc with 51 complaints (5%), and Portfolio Recovery Associates, Inc with 27 complaints (3%). Of these three, Encore is the parent company of Midland Funding, the debt buyer which files the most cases in Maryland and Portolio Recovery Associates is the second largest debt buyer. Expert Global Solutions, Inc. is the parent company of debt collector NCO, mentioned in this recent blog post about the NCLC’s report on student loan collection.

These three companies are followed by a string of large banks, including Capital One, Citibank and GSE Sallie Mae, with nearly as many complaints as Portfolio Recovery Associates. Some 241 companies, ranging from BB&T Financial and Paypal to assorted small law firms, have less than 5 complaints each.

Complaint Outcomes

The CFPB also records the outcomes of complaints: whether a complaint was responded to in a timely manner, whether the consumer disputed the response and the general nature of the ultimate resolution. Companies replied to 914 (95%) of complaints timely, and consumers disputed 172 (19%) of those replies. The most common resolution was “closed with explanation”, in 674 cases (74% of replies), followed by “closed with non-monetary relief” in 173 (19% of replies). Monetary relief was given in only 19 cases (2% of replies). 40 complaints (4%) were simply “closed” and the remainder were still in progress.

The top three companies showed significant differences in their reactions to complaints. While all three responded to all, or virtually all complaints, each seems to have dealt with complaints differently. Encore Capital Group closed 55 (72%) of its cases with an explanation and offered non-monetary relief in another 20 (26%). Expert Global Solutions closed all cases with an explanation (except those still in progress). Portfolio Recovery Associates was far more likely to offer non-monetary relief: 18 (67%) of its cases closed with this. The remainder “closed with explanation”.

Because the complaints are spread among so many companies, it is difficult to say much about variations in the type of complaint by company. Broadly, the most complained about companies see the same distribution of complaints as the complete data set. Surprisingly, banks like Capital One (41%) and Wells Fargo (42%) see a similar proportion of complaints about attempts to collect debts not owed as debt-buyers like Encore (45%) and Portfolio Recovery Associates (52%). Other banks see a different distribution, like Citibank, with only 19% of complaints about attempts to collect debts not owed, and 42% about its communications with customers.

Are the worst kinds of abuses committed by particular kinds of company? The data suggest not. Threats of arrest for debt were scattered. NME Services, Inc., with two such complaints, is a payday lender. Cash America International, with one, operates pawn shops. But household names Wells Fargo, JPMorgan Chase and HSBC also had such complaints, while heavily complained-about collectors like Encore and Portfolio Recovery Associates did not.

What We Can’t Learn

The CFPB’s data provide a fascinating window on the problems consumers have with debt collection, but it does have its limitations. The consumers who appear in the data are only those who actively complained. Not included will be those who did not have the time or resources to submit a complaint, who did not know they could complain to the CFPB, and who did not realize they had been treated improperly. The last category is particularly important since some of the most extreme forms of abuse play on the consumer’s lack of knowledge: threats of arrest or claims that non-payment is a criminal offense are not likely to result in a complaint if the consumer believes the threat or claim. Similarly, the consumers who complained about being sued without notice are only those who later discovered that they had been sued.

More Information

The CFPB’s consumer complaints database contains a huge amount of information, so here are some other analyses:

Deloitte (September 2013) – focusing on mortgages nationally

Woodstock Institute (October 2013) – focusing on Illinois

InsideARM (November 2013) – focusing on debt collection